- The Human Guide

- Posts

- The AI Power Map Is Being Redrawn

The AI Power Map Is Being Redrawn

Plus: Meta’s $2B AI bet, Singapore’s quiet leverage, and enterprise AI finally getting real

Hello, Human Guide

Today, we will talk about these THREE stories:

Meta makes a $2B-plus AI acquisition to bulk up its ecosystem

Singapore becomes the only Southeast Asian country in America’s AI “inner circle”

Enterprise AI quietly shifts from pilots to daily work

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Meta’s $2B AI Bet Signals a New Phase

Meta just wrote a check big enough to change its AI posture overnight.

Reuters reports Meta agreed to acquire AI startup Manus in a deal valued at more than $2 billion, adding millions of paying users and proprietary models to its stack. The acquisition follows Meta’s $50B-plus annual AI infrastructure spend and comes as its open-weight LLaMA models struggle to translate reach into durable revenue. The message is clear: scale alone is no longer enough.

What stands out is how defensive this feels. Late at night, laptop glowing, you can almost hear the internal dashboards refreshing as Meta realizes distribution without monetization leaves too much exposed. This is less about innovation and more about control—owning users, workflows, and recurring cash at once.

The implication is that the AI platform race is consolidating fast. Fewer independent winners. Bigger balance sheets deciding what survives.

If AI ecosystems now require both models and money machines, the real question is which players get locked out next.

Singapore Quietly Enters America’s AI Inner Circle

One small country just secured an outsized seat at the AI table.

Fortune reports Singapore is the only Southeast Asian nation included in the U.S.’s new AI-aligned supply-chain group, informally dubbed Pax Silica. The partnership focuses on advanced chips, cloud infrastructure, and trusted data flows at a time when export controls and geopolitical fragmentation are accelerating. No other ASEAN country made the cut.

What struck me is how deliberate this looks. Singapore didn’t win by having the biggest market, but by being boringly reliable—predictable regulation, fast permitting, and data centers that turn on when promised. At 7 a.m., under fluorescent office lights, reliability beats ambition.

The broader consequence is a reshuffling of AI geography. Influence is moving toward countries that can execute quietly, not posture loudly.

If AI power now flows through trust rather than size, the real question is which regions realize this too late.

Enterprise AI Finally Stops Talking and Starts Working

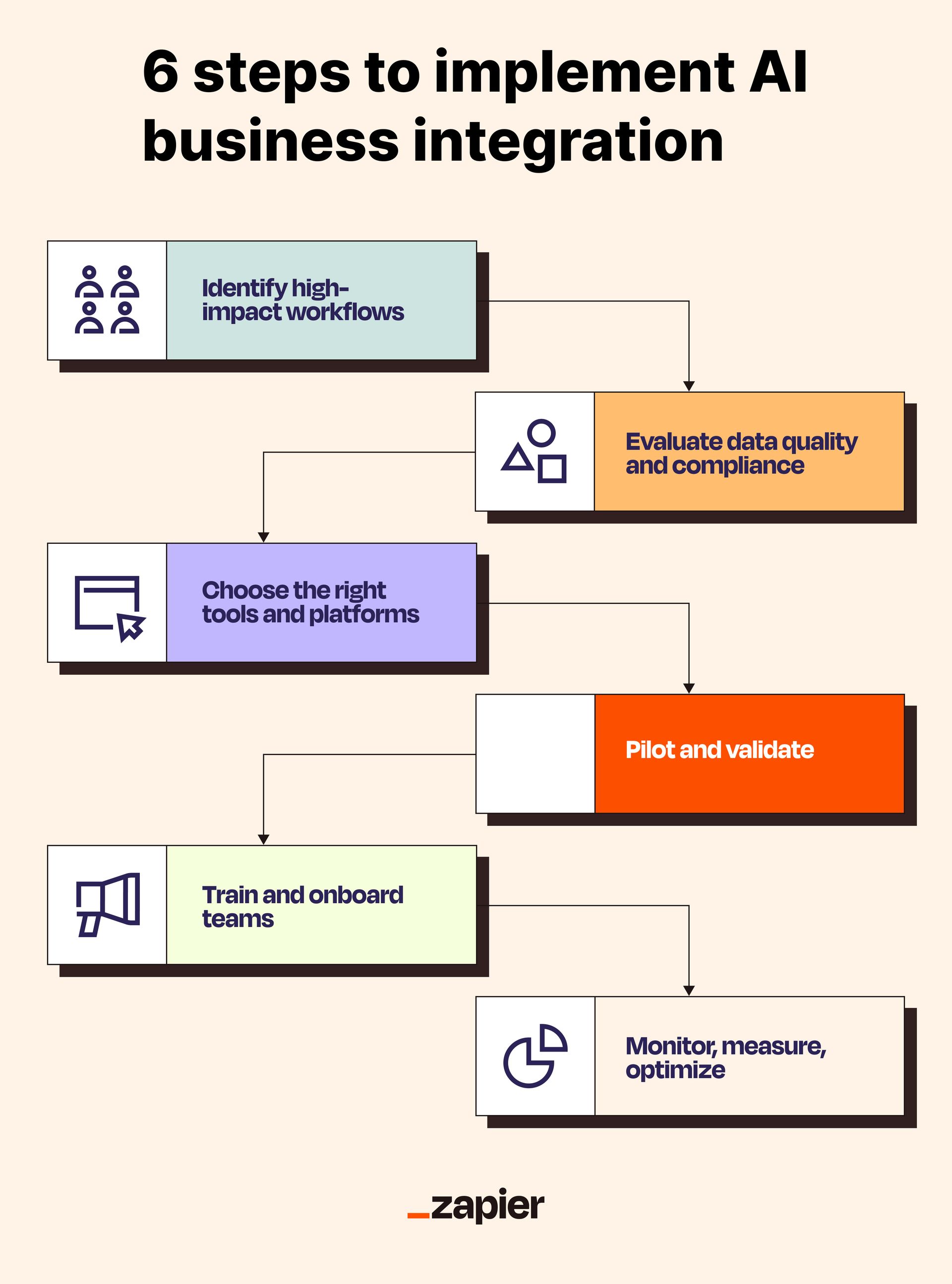

The AI hype cycle just slipped into a more interesting phase.

Barron’s reports enterprises are moving past pilots and into real deployment, with companies consolidating vendors and embedding AI directly into finance, support, and operations. After nearly three years of experimentation, executives say productivity gains are finally measurable—often small, but repeatable. Quiet gains beat flashy demos.

I think this shift feels different because it’s happening without applause. Late in the day, laptop fan spinning, teams aren’t bragging about models—they’re removing steps from workflows. This is less about intelligence and more about friction disappearing where humans hate it most.

The implication is brutal for startups. Tools that don’t slot cleanly into daily work get ignored, no matter how impressive the demo. Everything else gets cut.

If AI only wins when no one notices it anymore, the real question is how many “breakthrough” products fade into the background.