- The Human Guide

- Posts

- AI Just Went All-In—and Everyone Else Is Playing Catch-Up

AI Just Went All-In—and Everyone Else Is Playing Catch-Up

Plus: Nvidia hijacks CES, Elon Musk builds a GPU fortress, and Meta buys its way forward

Hello, Human Guide

Today, we will talk about these THREE stories:

Why CES quietly became the most important AI event of the year

How Elon Musk is betting everything on brute-force compute

Why Meta just spent billions to avoid falling behind

CES Didn’t Go Quiet—AI Took It Over

AI didn’t sneak into CES this year, it walked in wearing the keynote badge.

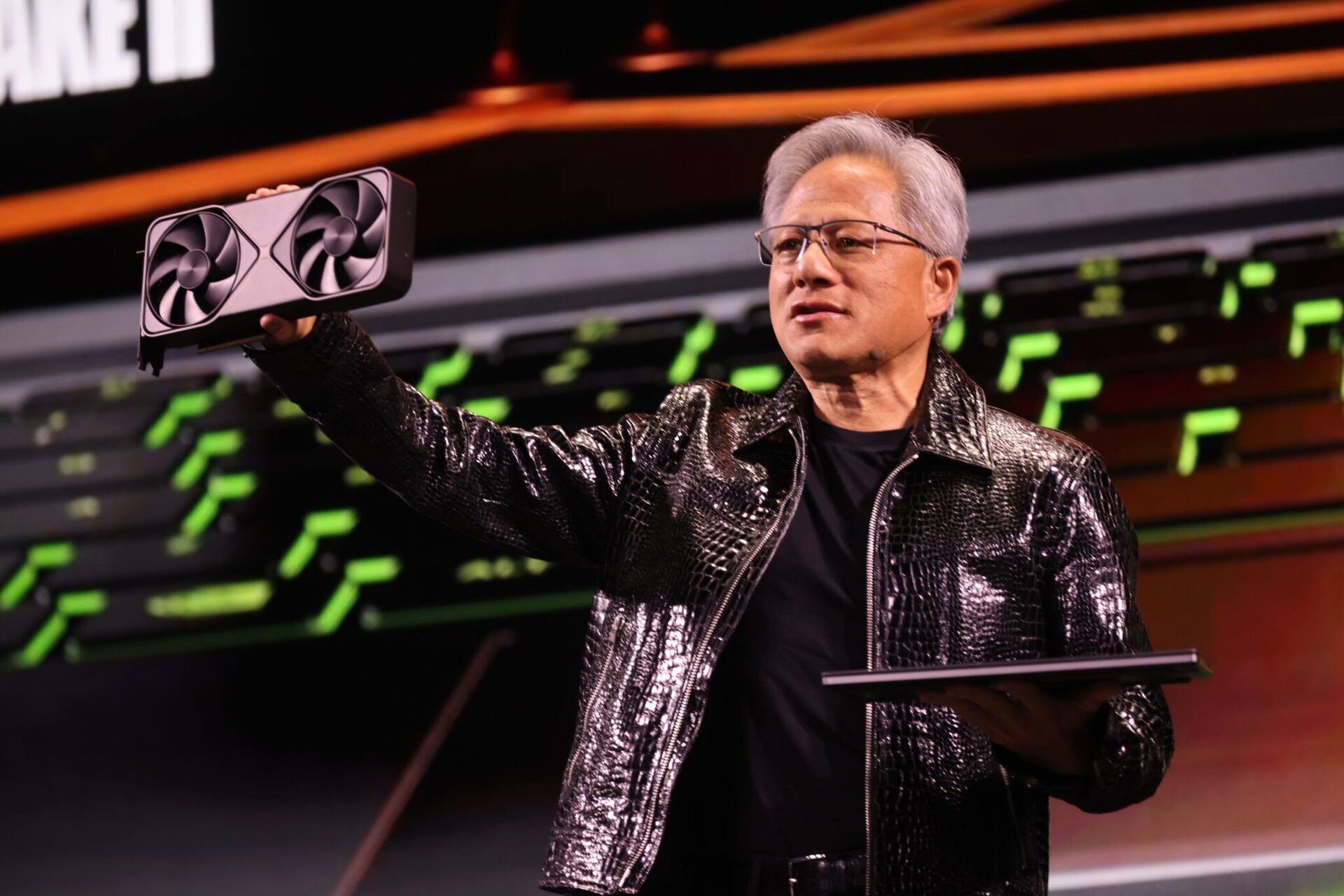

At CES 2026, more than 55% of major product announcements referenced AI directly, according to CES organizers, with chipmakers, automakers, and robotics firms all framing AI as the core feature rather than an add-on. NVIDIA CEO Jensen Huang used his keynote to outline a roadmap that ties generative AI, robotics, and edge devices into one continuous stack, from data center to living room.

What stands out is how physical this felt. This wasn’t about chatbots or demos running in browser tabs late at night. It was factory arms, in-car copilots, and devices humming under showroom lights, suggesting AI has crossed from software promise into hardware reality.

The implication is simple: AI is no longer a “feature cycle.” It’s the platform everything else is being rebuilt on.

If CES is now an AI conference, the real question is what happens to companies still treating AI as a side project?

Elon Musk Is Building a GPU Fortress

Elon Musk isn’t waiting for efficiency—he’s buying scale.

Reuters reports that xAI, led by Elon Musk, has acquired a third major facility dedicated to AI compute, part of a plan that could push its infrastructure past one million GPUs. That would put xAI in the same physical league as OpenAI, Google, and Meta, with capital spending measured in the tens of billions.

What struck me is how old-school this strategy feels. Instead of clever optimization or smaller models, this is raw industrial power—more chips, more electricity, more cooling—like building a steel mill and daring others to match it.

The bet is that intelligence still scales with hardware, and whoever owns the biggest pile controls the future pace of progress.

If AI turns into an arms race of megawatts and GPUs, the real question is who gets priced out before the models even ship?

Meta Just Bought Time With a $2B Check

Meta didn’t build this one—it bought it.

This week Meta acquired Manus, a Singapore-based AI startup, in a deal reportedly valued near $2 billion. The goal is to accelerate Meta’s internal AI capabilities across Facebook, Instagram, and future consumer products as competition from OpenAI, Google, and xAI tightens.

What bothers me is the subtext. This isn’t confidence, it’s urgency. Meta has talent, data, and distribution, but the pace of AI development is now so fast that building everything in-house risks falling irreversibly behind.

The broader signal is consolidation. Fewer independent AI labs. More talent pulled inside corporate walls. Higher barriers for newcomers.

If the fastest way forward is buying instead of building, the real question is how much genuine innovation survives this phase of the AI race?